Intercontinental Exchange Inc (NYSE:ICE), a leading operator of global exchanges and clearing houses and provider of mortgage technology, data and listings services, has witnessed a notable insider sell transaction. James Namkung, the company’s Chief Accounting Officer, sold 2,249 shares of the company on December 14, 2023. This transaction has caught the attention of investors and market analysts, as insider activities can often provide valuable insights into a company’s financial health and future prospects.

Who is James Namkung?

James Namkung serves as the Chief Accounting Officer at Intercontinental Exchange Inc. In his role, Namkung is responsible for overseeing the company’s accounting operations, financial reporting, and compliance with accounting standards. His position places him in a critical role to understand the company’s financial nuances and the implications of market trends on its performance. Namkung’s decision to sell a portion of his holdings in the company is therefore of particular interest to those following ICE’s stock.

Intercontinental Exchange Inc’s Business Description

Intercontinental Exchange Inc is a global powerhouse in the financial market infrastructure and technology sector. The company operates exchanges, including the New York Stock Exchange, and clearing houses that help market participants to trade and manage risk across multiple asset classes. ICE’s comprehensive services also extend to providing data and listings services, as well as mortgage technology solutions that facilitate the electronic workflow of the mortgage origination process. The company’s diverse portfolio of services underscores its integral role in the global financial ecosystem.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider transactions can be a double-edged sword when it comes to interpreting their impact on a company’s stock price. On one hand, insiders may sell shares for personal financial planning reasons that do not necessarily reflect their outlook on the company’s future. On the other hand, a pattern of insider selling could signal a lack of confidence in the company’s growth prospects or valuation.

Over the past year, James Namkung has sold 2,249 shares in total and has not made any purchases. This one-sided activity could raise questions about his confidence in the company’s valuation or future performance. However, without additional context, it is difficult to draw definitive conclusions from these transactions alone.

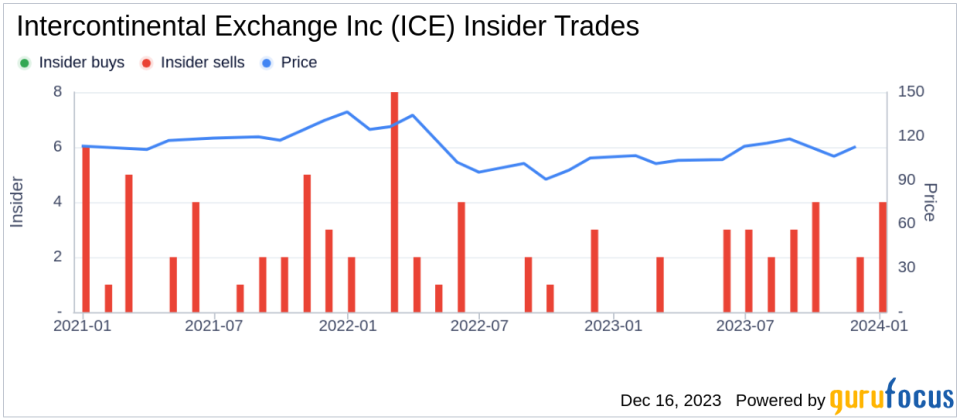

The insider transaction history for Intercontinental Exchange Inc shows a trend of more insider selling than buying over the past year, with 24 insider sells and no insider buys. This trend could suggest that insiders, as a group, believe the stock may be fully valued or that they are taking profits off the table.

On the day of Namkung’s recent sell, shares of Intercontinental Exchange Inc were trading at $122.4, giving the company a substantial market cap of $70.457 billion. The price-earnings ratio of 28.56 is higher than the industry median of 18.49 and also exceeds the company’s historical median price-earnings ratio. This elevated P/E ratio could indicate that the stock is priced on the higher end of its historical range, potentially justifying insider selling activity.

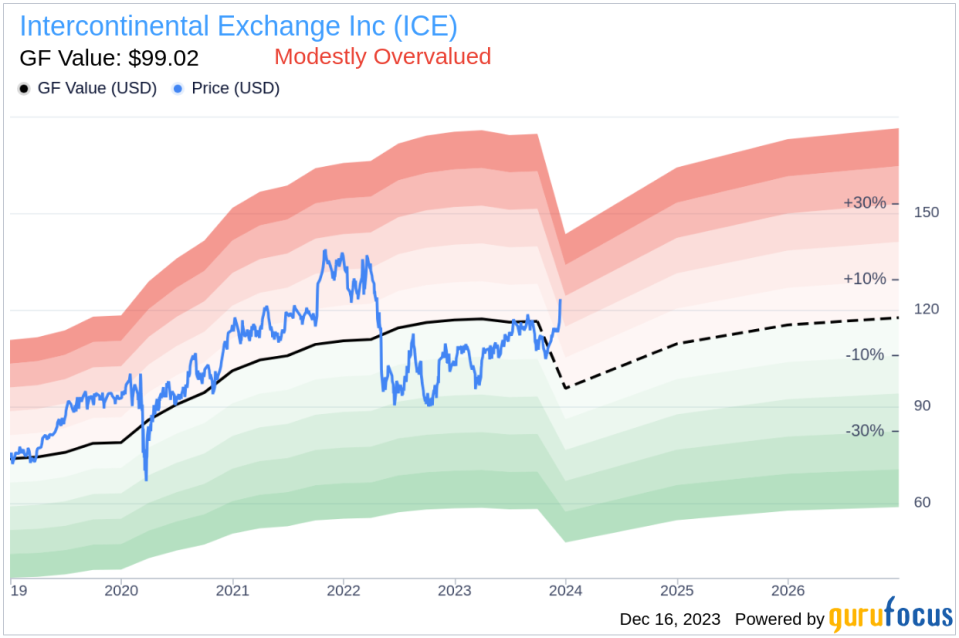

When considering the price-to-GF-Value ratio of 1.24, with a current price of $122.4 against a GuruFocus Value of $99.02, Intercontinental Exchange Inc appears to be modestly overvalued. This valuation metric suggests that the stock’s current price exceeds its estimated intrinsic value, which could be another factor influencing insider selling decisions.

The GF Value is a proprietary intrinsic value estimate from GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts. This comprehensive approach to valuation provides a benchmark for investors to consider when assessing the potential over- or undervaluation of a stock.

The insider trend image above illustrates the recent selling pattern among insiders at Intercontinental Exchange Inc, which could be interpreted as a cautious signal by market observers.

The GF Value image provides a visual representation of the stock’s current price in relation to its estimated intrinsic value, further supporting the notion that the stock may be trading at a premium.

Conclusion

James Namkung’s recent sale of 2,249 shares of Intercontinental Exchange Inc is a transaction that warrants attention from investors and analysts. While insider selling can have various motivations, the consistent pattern of insider sales over the past year, coupled with the company’s high price-earnings ratio and modest overvaluation according to the GF Value, may suggest that insiders are cautious about the company’s current valuation. Investors should consider these factors alongside broader market conditions and company-specific news when making investment decisions regarding Intercontinental Exchange Inc.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Credit: Source link