Dilok Klaisataporn

New Mountain Finance (Nasdaq: NMFC) is a business development company with a senior secured-lending focus in its investment portfolio and a 10% yield that is covered by NII.

My present stock classification for New Mountain Finance is Hold, a notch down from Buy, due to the BDC’s 1.5% non-accrual ratio as well as interest rate headwinds that are poised to affect its NII growth potential in a low-rate environment. New Mountain Finance’s stock is also selling at about NAV, resulting in an uncompelling risk/return relationship.

With softening tailwinds for NII growth in 2024 and a mostly floating-rate debt portfolio, the potential for special dividends is also quite substantially diminished, in my view.

My Rating History

New Mountain Finance’s covered dividend, special dividend potential in a high-rate environment, and discount valuation made NMFC a Buy earlier this year. However, the market environment has started to change this month with the central bank pointing to lower key interest rates next year.

New Mountain Finance is broadly positioned for higher interest rates and I think the income potential in a low-rate environment is limited, hence my new Hold stock classification.

Portfolio Composition, Senior Secured Loan Focus And Non-Accrual Status

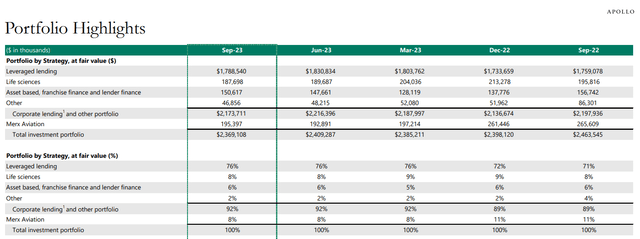

New Mountain Finance’s origination business has slowed considerably in the last twelve months as higher interest rates cooled off demand for new investment capital.

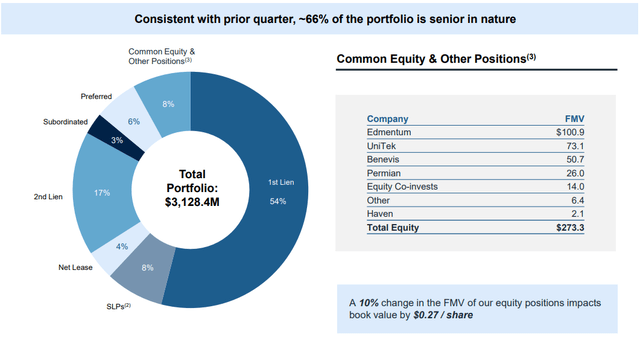

As of the end of the third quarter, New Mountain Finance had $3.1 billion in investments in its portfolio, mainly First and Second Liens (a total of 71% of investments).

With that being said, a solid 8% of the BDC’s investment portfolio was allocated to Equity investments that have the potential to boost New Mountain Finance’s total returns and might lead at some point to a lucrative exit.

Portfolio Overview (New Mountain Finance)

As far as portfolio originations are concerned, New Mountain Finance was subjected to changing industry dynamics in 2023 which were primarily related to higher debt costs for the BDC’s borrowers. In the third quarter, the BDC only originated 15.6 million in new loans, the lowest quarterly amount in the last year, while receiving a total of $75.4 million in repayments.

3Q-23 was the third quarter since 4Q-22 in which the BDC has experienced negative net originations (accounting a faster pace of repayments as well as loan sales).

Portfolio Highlights (New Mountain Finance)

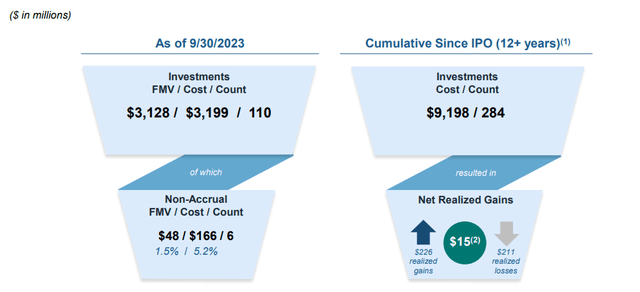

New Mountain Finance’s non-accrual ratio as of September 30, 2023 was 1.5% based on fair value which implies that the non-accrual remained unchanged compared to the second quarter. I generally view a non-accrual ratio of 1.5% or higher as starting to be problematic, with few exceptions.

I was lenient towards New Mountain Finance previously, as the company had a 1.8% non-accrual ratio last time I reviewed the BDC, but this was during a time of growing NII.

With interest rates now set to get slashed, the BDC is unlikely to see the kind of NII growth next year that it saw in 2023.

Non-Accrual Ratio (New Mountain Finance)

Dividend Coverage And Limited Special Dividend Potential In 2024

The central bank has changed the NII outlook for floating-rate positioned BDCs like New Mountain Finance. The BDC had 88% of its investments allocated to floating-rate debt in 3Q-23, which obviously, in a low-rate environment is better than 100% floating-rate debt exposure.

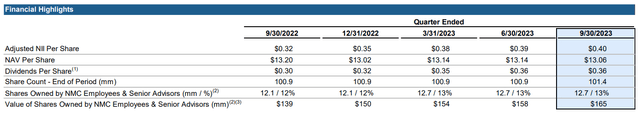

The change in interest rates makes me cautious about the NII potential of New Mountain Finance in 2024. The BDC’s adjusted NII was up 25% YoY in 3Q-23 while its dividend rose 20% YoY, so New Mountain Finance did return a lot of its incremental earnings to shareholders in 2023, partially through special dividends.

New Mountain Finance also just declared a special distribution in the amount of $0.10 per share which is set to be paid on December 29, 2023 to shareholders of record as of December 22, 2023.

New Mountain Finance’s payout ratio in the last twelve months was 91%, so New Mountain Finance could afford to announce its special dividend. However, I think the ability of floating-rate BDCs to make special distributions to shareholders in 2024 will be substantially diminished as the central bank is set to push loan rates down.

Financial Highlights (New Mountain Finance)

New Mountain Finance Is Now A Hold

New Mountain Finance sells for a 2% discount to NAV which is mostly in line with the NAV multiples of other mostly floating-rate BDCs like Golub Capital BDC (GBDC), Goldman Sachs BDC (GSBD), and Blue Owl Capital Corporation (OBDC).

Though I don’t see much of a valuation discrepancy between New Mountain Finance and the peer BDCs listed above, I think that the entire sector is primed for underperformance in 2024.

Since the BDCs mentioned here all sell for about NAV, I think that passive income investors don’t get to enjoy any kind of substantial margin of safety at the current time.

I would consider reviewing BDCs, and increasing my exposure to the sector overall, if BDCs started to sell for 0.9x or lower NAV multiples in the future.

New Mountain Finance And The Central Bank

There is no other factor, in my view, which will have as much of an influence on the BDC’s NII performance and NAV multiple, than the central bank’s policy with respect to interest rates.

A slower-than-expected pace of rate cuts could yield elevated NII for a while longer, but the writing for BDCs, particularly those with large floating-rate investment portfolios, is already on the wall, in my view.

My Conclusion

New Mountain Finance is a senior secured-focused BDC company with substantial Equity investments, but prospects for debt-related portfolio income growth have greatly deteriorated in December.

The central bank is going to push for lower key interest rates next year which makes it quite impossible for New Mountain Finance or other BDCs to produce 20-25% YoY NII growth in 2024.

As central bank-driven effects of higher interest rates wear off, I think that headwinds for floating-rate BDCs in particular are set to gain steam in 2024.

As such, due to considerations of prudence and caution, I am modifying my stock classification for NMFC to Hold.

Credit: Source link